Figure payroll taxes

Sign up make payroll a breeze. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

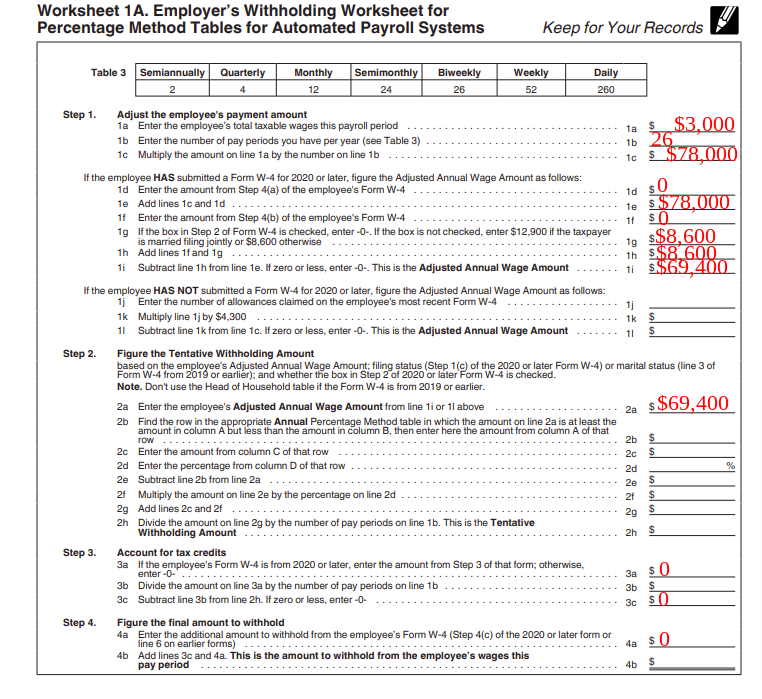

The first step to calculate payroll taxes is calculating the wages earned by each employee and the amount of taxes that need to be withheld as part.

. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Get Started With Limited Offers Today. Both you and your employee contribute 765 to FICA.

They are withheld from their paychecks by their employer who then pays. Time and attendance software with project tracking to help you be more efficient. How Your Paycheck Works.

Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. Adjusted gross income Post-tax deductions Exemptions Taxable income For post-tax deductions you.

It only takes a few seconds to. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Sign up make payroll a breeze.

Free Unbiased Reviews Top Picks. Ad Compare This Years Top 5 Free Payroll Software. The calculator includes options for estimating Federal Social Security.

The other federal taxes do have standard amounts they are as follows. Focus on Your Business. Get Started Today and See Why Over 24 Million Businesses In 160 Countries Love Us.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. Keep in mind that workers that make less than 35568 per. Discover ADP Payroll Benefits Insurance Time Talent HR More.

Simply the best payroll software for small business. Get Started With ADP Payroll. Now you need to figure out your taxable income.

The first 137700 of wages are subject to the. Ad Get It Right The First time With Sonary Intelligent Software Recommendations. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Free Unbiased Reviews Top Picks. Taxes Paid Filed - 100 Guarantee. Ad Try the Online Payroll Software That Saves You Time and Easy To Track Every Payday.

Social Security tax 124. Ad No more forgotten entries inaccurate payroll or broken hearts. 62 for Social Security and 145 for Medicare.

This is divided up so that both employer and employee pay 62 each. Make Your Payroll Effortless So You Can Save Time Money. Payroll taxes are taxes based on salaries wages commissions and tips an employee makes.

Ad 4 out of 5 customers reduce payroll errors after switching to Gusto. The total tax amount is 124. Social Security tax is a payroll tax that both employers and employees contribute to equally.

The employee pays half 62 and the employer pays. Ad Compare This Years 10 Best Payroll Services Systems. Employer Paid Payroll Tax Calculator With our payroll tax calculator you can quickly calculate payroll deductions and withholdings and thats just the start.

Ad Process Payroll Faster Easier With ADP Payroll. For example if an employee earns 1500 per week the individuals annual. The standard FUTA tax rate is 6 so your max.

For employees on an annual salary you can simply divide their total salary by the number of pay periods in a year. Take Advantage of Everything Payroll Has To Offer. What are payroll taxes.

It can be tough to figure out how. Simply the best payroll software for small business.

Payroll Tax What It Is How To Calculate It Bench Accounting

Payroll Formula Step By Step Calculation With Examples

The Basics Of Payroll Tax Withholding What Is Payroll Tax Withholding

How To Pay Payroll Taxes A Step By Step Guide

Payroll Taxes How Much Do Employers Take Out Adp

Payroll Journal Entries For Wages Accountingcoach

How To Calculate Payroll Taxes Methods Examples More

Calculate Taxes On Paycheck Top Brands 59 Off Lamphitrite Palace Com

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Net Pay Step By Step Example

Excel Formula Income Tax Bracket Calculation Exceljet

How To Do Payroll In Excel In 7 Steps Free Template

A Visual Representation Of How To Do Your Payroll Taxes Infographic Payroll Taxes Payroll Accounting Payroll

Federal Income Tax Fit Payroll Tax Calculation Youtube

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Template Payroll Checks

Payroll Tax What It Is How To Calculate It Bench Accounting

How To Calculate Payroll Taxes Methods Examples More